7 Money Mindset Shifts To Help You Leave Your Job

Is money the main thing holding you back from the career you want? Today we’re talking about 7 money mindset shifts to help you leave your job.

When you first started working, your career priorities probably looked something like:

Good job

Steady paycheck

Promotion…accompanied by more money

You now know that money alone is no substitute for compelling, meaningful work.

Yet even if you dread staying on your current path, it’s easy to assume a career change will mean less money and drastic lifestyle changes.

Is Your Paycheck Keeping You Stuck?

Money should be a key enabler for your career and life goals, not the thing that’s keeping you stuck.

The global percentage of disengaged workers is 85%, according to a June 2017 Gallup poll.

That’s a lot of disengaged people. Yet so many of these 85% choose to stay in a job they hate because of the paycheck.

I get it. I’ve been there myself.

Even if making good money wasn’t something you set out to do, it can be incredibly challenging to imagine your life with even a little less of it.

I’m not here to tell you whether you should stay or leave.

I’m definitely not going to say that money is bad.

I am going to encourage you to understand the real value of your paycheck (as well as the some of the hidden costs), so you can make informed, intentional decisions about your career and life for the long-term.

I’m also going to point out the limiting beliefs that trick you into thinking that leaving your job for work you love means earning less (it doesn’t!)—and help you make the necessary money mindset shifts to get what you want in your career.

Serious about reframing the limiting beliefs keeping you stuck? Check out my money mindset course 👇

Serious about reframing the limiting beliefs keeping you stuck? Check out my money mindset course 👇

Here Are 7 Money Mindset Shifts To Help You Leave Your Job

1. Nail Down Your Number

The first money mindset shift is nailing down a real-life dollar amount.

Do you know how much money you need to meet your goals?

I don’t mean a vague sense that you need a lot more or a giant retirement target number. Nor am I asking what you spend.

I mean an actual bottom-up breakdown of what you truly need to make each year.

With a few budget tweaks, the difference between what you currently make and what you need will likely surprise you.

It also might give you the freedom to consider a career that brings you a lot more purpose . . . and still pays the bills.

Unless you’re already super intentional and rigorous in tracking your expenditures versus your actual money goals, there’s likely a lot of waste.

I did it myself when I went part-time in my corporate career to launch my business. By making a few savvy budget decisions, I absorbed a 25% pay cut without feeling the pinch. And knowing the exact number I needed to quit for good helped combat the fear of taking a leap.

Giving up manicures or a few meals out every month could be a game changer for your career. Isn't it worth a look?

At the very least, you’ll bring awareness and intention to how you’re spending money. You’ll make choices based on dollar amounts and priorities rather than fear.

Once you nail down your number, you can explore the options to get there.

2. Set your calendar

Another simple, practical money mindset shift is marking your leave date on your calendar. Even better, share that date with everyone you can.

It’s especially important if you’re staying temporarily to meet a specific money goal.

There’s nothing wrong with having money goals. In fact, I encourage it. Isn’t that the point of working??

But staying indefinitely out of fear of making less or to make an amorphous amount of more are surefire ways to end up years down the road questioning what the heck happened.

One of my biggest money mindset challenges is fear of not having enough. When I was a kid, there was a palpable daily fear of losing our house, not being able to pay bills, running out of money at the grocery store—you name it.

As an adult, the fear morphed into there’s never enough. No matter how much I made, the memory of not enough ran my decisions.

Every decision impacting my income, especially leaving my job to run a business, ended up with a vision of me living under a bridge. I wish I were joking. The fear was real.

For my last three years in corporate, I told myself, “Just one more year…”

Finally, after announcing I was finally-going-to-leave-in-February-for-real-this-time-after-the-next-bonus-cycle, one of my coach friends asked, “Why February? Why not March or today or next Fall?”

I was finally able to give him a real answer because I’d nailed down my number. I knew:

The minimum I needed to earn to enjoy life (and not have daily freak outs),

The maximum I wanted to earn to really enjoy life,

How much I needed in my emergency fund just in case.

Could I have stayed another 1, 2, 20 years? Yes! But nailing down my number and setting my calendar helped me separate the fear (there will ALWAYS be fear) from the cold, hard numbers.

For me, calculating the dollar amount of enough was priceless.

If you’re staying for the money, what’s the amount you hope to earn, and what will you use it for? Maybe it’s to squirrel away 1-3 years of savings, hit a target number in your 401k, or take a special vacation for your 30th birthday.

Know your number and the goal behind it.

If you decide to stay for the paycheck, make it mean something. Set a dollar amount, mark your calendar, then leave once you’ve hit it.

Don’t fall into the just 1 more year trap.

Ready NOW for a fulfilling career that PAYS? Check out my money mindset course 👇

Ready NOW for a fulfilling career that PAYS? Check out my money mindset course 👇

3. Calculate Your Hourly Wage

Our third money mindset shift is putting your earnings in context. And creating the runway to earn more.

A lot of people look at their annual salary, or even their monthly take-home, as a key measure.

But what does that number really mean?

If your $100k salary is divided across 50+ hour weeks and working vacations, what’s your real hourly wage? Don’t forget to add in the Sunday Sick Pit time you spend trying to get ahead on email or trying not to think about work.

Even a slightly lower salary at a predictable 40 hour-a-week job could increase your hourly wage. And if you chose to put that extra time saved into an income-generating side hustle or passion project, you could increase your hourly take-home even more.

Consider how you might increase your hourly worth—whether it's cutting back on your time spent in your existing job or landing a new one.

Amazing things happen when you put a real dollar value on your time.

4. Time Is the New Money. What’s Yours Worth?

Many people reach out to me when they've arrived at an important tipping point: their free time has become more valuable than their time at the office.

This is not to say that their paycheck is no longer important.

On the contrary, their key question is often something like, “How do I find fulfilling work that still pays the bills?”

They’ve simply decided to place a premium on their free time—and be more intentional about spending their time at work on the things that matter most.

Some realize the value of their time because they’re done giving their life away to work that doesn’t light them up.

Others want to use that time on a strategic side hustle or invest in their education to meet longer-term goals.

Still others would trade a fair amount of money for more time with their family, friends, or a worthy cause.

Fast forward 5, 10, 20 years from now. What do you want to say about the time-money ratio in your career and life?

For some, the dollars gained might be well worth the time spent at a job you dislike.

Most people I work with have reached a point where spending their time and energy on the people and topics most important to them is invaluable.

Know the right answer for yourself.

5. Focus On the Upside

One of the most powerful money mindset shifts you can make is focusing on your potential gains (versus potential losses).

I often hear comments like, “I can be creative, or I can make money,” or “I'd love to follow my passion, but I have a mortgage.”

Making money and finding work you enjoy are not mutually exclusive.

Similarly, remember what you could gain by leaving a job you dislike—financially and otherwise.

Your brain will constantly remind you of what you have to lose. Refocus on what you have to gain.

If your goal is to make the same amount of money or more, great! Now you can filter out the opportunities that require you to take a pay cut, and focus on the ones that improve your financials.

The challenge is to remember the upside, including the myriad opportunities to earn increased income in a role where you’re also valued for your contributions.

And don’t forget the value of increased confidence, improved mental and physical health, and renewed energy to focus on what brings you joy within and outside of work. There’s a real cost of staying in an unfulfilling career.

If you’re rolling your eyes at the quality of life stuff, I’m also talking about earning potential in cold, hard cash. Your corporate income will ultimately be capped…while the financial upside for side hustles and entrepreneurial endeavors is limitless.

One of the things I love most about being an entrepreneur is that I have so much more control over how much I make and how I make it.

If I need to make an extra 10k this year, I can increase my prices, find new clients, or offer a new service. And back to #3 above, I also get to decide how much time and effort I put in. You just can’t do that working for The Man. If that’s not freedom and flexibility, I don’t know what is.

Lastly, consider the financial upside not just for the next year but over the remainder of your lifetime. Yes, I took a temporary pay cut when I went part-time in corporate, but I’ll make that money back and far more over the lifetime of my business. Plus, you cannot beat the entrepreneurial lifestyle.

Working from wherever you want, whenever you want, and never setting an alarm again: priceless.

Key money mindset shift: Don’t assume you have to take a pay cut. But if you do, look at how that initial investment can pay off in the long run.

6. What Does Money Represent For You?

One of the biggest money mindset shifts you can make is understanding what money represents for you.

Unless you’re planning to sleep on your pile of money (I prefer pillow-tops), recognize your paycheck is not about having money for money’s sake.

Money is a way to measure value. Beyond affording us basic necessities, money is often a stand-in for something much deeper.

Even luxuries of experience—like travel, early retirement, and college education—fulfill a greater need.

For some, money represents safety. For others, it’s power and status. Still others associate it with freedom, flexibility, peace, love, or acceptance.

But let’s take a closer look.

If you’re tied to your job for the paycheck, you’re the opposite of safe; you’re dependent on the whims and interests of your employer.

If you’re staying at a job that doesn’t allow you to reach your potential, I’m guessing the last thing you’re feeling is empowered.

And are you really feeling free, peaceful, and valued in your current job?

Understand what money means for you to unlock its real power. Then use it as a tool to help you achieve your goals—financial and otherwise.

Your money choices reflect your priorities. Are they aligned with what you want?

If you're ready to uncover where you're creating barriers and holding yourself back, check out the course below 👇

If you're ready to uncover where you're creating barriers and holding yourself back, check out the course below 👇

7. You Always Have a Choice

I don’t want you to settle for anything less than what you’re worth. Ever.

That’s why I struggle when people languish in jobs that pay them hefty salaries but disrespect their time, dignity, and/or personal development. What does that say about the value you place on yourself?

When you’re locked into a paycheck, it can feel like you don’t have a choice.

The truth is that every day you choose whether to stay or leave. You’re in charge.

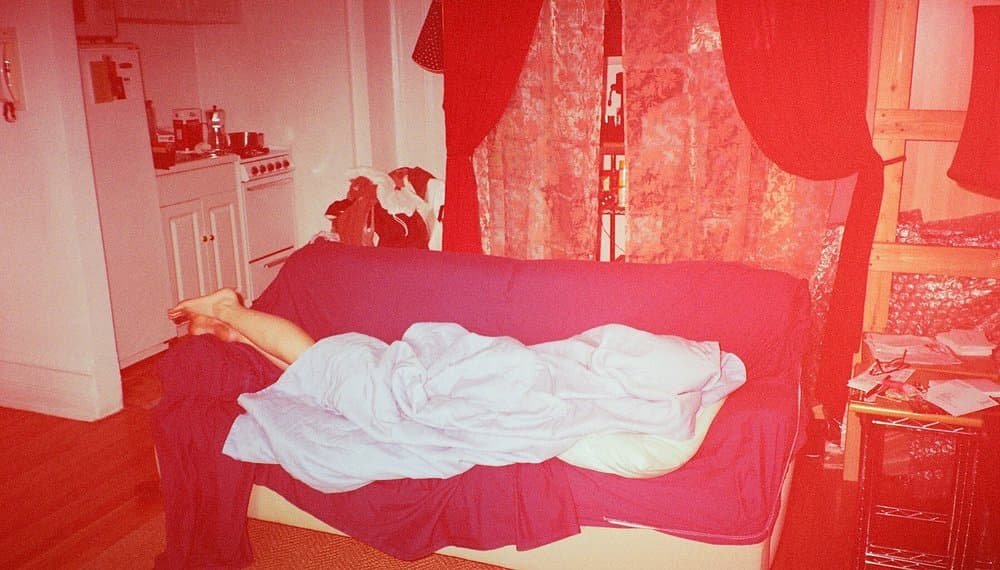

NYC Livin'! Kitchen on the left, Bedroom up the ladder to the right. Obligatory couch-surfer in the foreground. It was a huge money mindset shift from this to a 1-bedroom in a luxury doorman high-rise. But boy did it shift my outlook.

Take it from someone who chose to live in a less than 300-square foot studio for 7 years to live below her means. You want to talk about transformative money-goal-moments, imagine climbing this ladder to your twin bed (not even a pillow-top) well into your 30s.

I’ve also stayed in jobs I hated to meet important money goals, so I’m not advocating a grass-is-always-greener-quit-your-job-today approach here.

I’m simply asking you to think through the true costs and benefits of your current paycheck, decide for yourself, and make a plan that puts you on a career trajectory you feel good about.

I’ll support you, whatever you choose.

Continue Your Money Education Beginning with Money Mindset Shifts

Interested in learning more? Here are 3 ways:

If you’re ready to challenge your limiting money beliefs and get on the path to a fulfilling and prosperous career, check out my money mindset course.

If money mindset is getting in the way of your career goals and you’re ready to take serious action, let's talk.

If you’re not ready to make any big money moves but want to learn more, here’s a list of my favorite personal finance and money mindset resources.

The path to a fulfilling, prosperous career begins with the money mindset shifts that help you see opportunities you simply couldn’t see before.

Ready for a career that matches who you are?

Grab the free guide: 4 Steps to Take Back Your Life and Design a Career with Purpose

Learn how to work through the right options for you and find opportunities you didn't even know were possible.

Author Bio:

Before becoming a coach, Caroline worked in management consulting and financial services. She's made it her mission to help people grow, contribute, and get wherever they want to go.

She’s also a tennis fanatic, aspiring Minimalist, FIRE (Financial Independence and Retire Early) enthusiast, and Aloha Spirit seeker 🤙. She loves to share stories from her unconventional life and career focused on freedom, creativity, fun, health, family, and community. If she can do it, you can, too.

The life and career you want is truly possible once you have the roadmap. Take the first step by downloading her free guide.